What makes a collectible whisky?

A collectible scotch is a bottle of whisky that holds value beyond its original purchase price due to various factors. These factors contribute to its desirability among whisky enthusiasts, collectors, and investors. Here are some key elements that make a whisky collectible:

- Rarity: One of the most important factors is the rarity of the whisky. Limited editions, special releases, or whiskies from closed distilleries are highly sought after by collectors. Whiskies with a limited production run or those that are no longer available on the market tend to hold higher value.

- Age: The age of a whisky can significantly impact its collectibility. Older whiskies, especially those that have been well-aged for several decades, are often considered more valuable and desirable. The extended maturation process can enhance the complexity and depth of flavors, making them highly coveted by collectors.

- Brand and Distillery Reputation: Whiskies from well-established and renowned distilleries often have a higher collectible value. Distilleries with a long-standing history of producing exceptional whiskies or those with a unique style or production technique tend to attract collectors. Limited editions or special releases from prestigious distilleries often become highly sought after.

- Packaging and Design: The visual appeal of the packaging and bottle design can influence the collectibility of a whisky. Special editions featuring unique labels, intricate bottles, or decorative boxes can enhance the overall value and desirability among collectors.

- Awards and Recognition: Whiskies that have received awards and recognition from prestigious whisky competitions or industry experts often become sought after by collectors. These accolades serve as a testament to the quality and craftsmanship of the whisky, elevating its collectible status.

- Significance and Historical Value: Whiskies associated with significant events or historical moments in the whisky industry can become highly collectible. For example, whiskies commemorating anniversaries, special occasions, or limited releases tied to notable personalities or milestones tend to attract collectors interested in preserving whisky history.

- Condition and Authenticity: The condition of the whisky and its packaging is crucial for collectors. Well-preserved bottles with intact labels, seals, and packaging hold higher value. Additionally, ensuring the authenticity of the whisky is essential, as counterfeit bottles can significantly diminish its collectible worth.

- Demand and Market Trends: The overall demand and market trends play a role in determining the collectibility of a whisky. Whiskies that align with current trends, such as specific regional styles, cask finishes, or flavor profiles, may see increased interest from collectors.

Brief History of Whiskey

Whisky, also spelled whiskey, has a rich and fascinating history that dates back centuries. The origins of whisky can be traced to different regions, including Scotland, Ireland, and other parts of the world.

The early history of whisky production is believed to have started in ancient Mesopotamia, where evidence of fermented grain beverages has been found. The art of distillation, which is the process of converting fermented grain into a concentrated alcoholic spirit, likely originated in the Arab world during the medieval period.

In Scotland, whisky production began to emerge in the late 15th century, with the monastic orders being instrumental in its early development. The monks used their knowledge of distillation to produce aqua vitae, a distilled spirit that was used for medicinal purposes. Over time, the production of aqua vitae evolved into what is now known as Scotch whisky.

In Ireland, whiskey production has a long history as well. Irish monks are credited with introducing the art of distillation to the country in the 6th century. Irish whiskey became popular and gained a reputation for its smooth and light character.

Whisky production also spread to other countries, such as the United States. In the late 18th century, Scottish and Irish immigrants brought their distillation techniques to America, leading to the development of American whiskey. Bourbon, a type of American whiskey, gained recognition and became a significant part of American culture.

The production and consumption of whisky continued to evolve over time, with different countries and regions developing their own styles and regulations. Today, whisky is enjoyed by people all around the world, with each country having its unique traditions, production methods, and flavor profiles.

Whisky has become not only a beloved beverage but also a symbol of craftsmanship and cultural heritage. It is appreciated for its diverse range of flavors, aging processes, and the artistry involved in its production. The history of whisky is intertwined with the stories of distillers, regions, and traditions, making it a captivating subject for enthusiasts and connoisseurs alike.

Collectible whiskies can be seen as a combination of art, history, and craftsmanship. Their value extends beyond their liquid contents, making them highly sought after by whisky enthusiasts and collectors alike.

As with most products, reputation, scarcity and exclusivity are very important.

Martin Green, head of whisky at the Bonhams auction house, suggests starting with the main range, available from any whisky specialist and then progressing to exclusives from distilleries, but he warns to look out for forgeries.

He says: ‘If you are in any doubt consult the relevant distillery. They are usually happy to provide information on authenticity to anyone who asks.’

He adds: ‘If it’s to drink, then buy what you like drinking and gradually refine your palette as you become more experienced. If it’s to collect, the usual advice is to buy the best you can afford but, of course, some collectors will be buying to plug gaps in their collections. ‘

But ultimately it can be a very subjective investment and you are not guaranteed a return so could just be better off drinking and enjoying it.

Andy Simpson of RW101 says: ‘One person’s investment or collection today can be another’s drink tomorrow. Stick to limited editions, single casks, discontinued bottles and older rarities from the iconic collector’s distilleries.’

What makes a fine whiskey?

A fine whiskey is characterized by several factors that contribute to its quality and distinction. Here are some key elements that define a fine whiskey:

- Ingredients: The choice and quality of ingredients play a crucial role in crafting a fine whiskey. Typically, whiskey is made from grains such as barley, corn, rye, or wheat. The selection of high-quality grains, along with pure water and yeast, is essential in creating a flavorful and well-balanced whiskey.

- Distillation Process: The distillation process is critical in shaping the character of a whiskey. It involves heating the fermented mash to separate alcohol from impurities and concentrate the flavors. The skill and expertise of the distiller in carefully monitoring the distillation process can significantly impact the final product.

- Aging: Aging is a vital aspect of whiskey production. Whiskey is typically aged in wooden barrels, often made of oak, for a specific period. During aging, the whiskey undergoes chemical reactions with the wood, which contribute to its flavor, aroma, and overall complexity. The length of aging can vary depending on the type of whiskey and the desired characteristics.

- Maturation: Whiskey maturation refers to the time the spirit spends in the barrel, allowing it to develop and mellow over time. During maturation, the whiskey interacts with the wood, absorbing flavors and tannins, while also undergoing oxidation. This process adds depth and complexity to the whiskey’s profile, enhancing its smoothness and richness.

- Flavor Profile: A fine whiskey exhibits a well-balanced and harmonious flavor profile. It should have distinct notes of grains, fruits, spices, and oak, with a pleasant aroma and a smooth, lingering finish. The complexity and depth of flavors can vary depending on the type of whiskey, such as Scotch, bourbon, or Irish whiskey.

- Craftsmanship: Fine whiskey is often the result of meticulous craftsmanship and attention to detail throughout the production process. From selecting the finest ingredients to carefully monitoring fermentation, distillation, and aging, skilled distillers ensure that every step is executed with precision and expertise.

- Authenticity: Authenticity is highly valued in the world of whiskey. Fine whiskey often reflects the traditions, heritage, and unique characteristics of its country or region of origin. Distilleries that uphold traditional production methods and adhere to specific regulations contribute to the authenticity and integrity of the whiskey.

- Reputation: The reputation of a whiskey brand or distillery can also indicate its quality. Established distilleries with a long history of producing exceptional whiskey and receiving recognition and awards for their products often earn a reputation for excellence.

It’s important to note that personal taste and preferences also play a significant role in determining what constitutes a fine whiskey. Each individual may have different preferences for flavor profiles, styles, and regions. Exploring a variety of whiskeys can help develop an appreciation for the diverse range of styles and find the ones that resonate with your palate.

How can you invest in whisky?

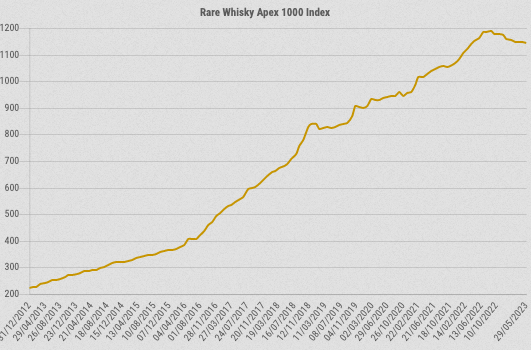

Whiskies: RW101 also tracks the distilleries with the best investments

Our extensive database has been evolved for more than ten years and contains factual, accurate open market values for the sale of bottles of Single Malt Scotch covering different bottlings.

These are not bottles you would buy in the local off licence. Whisky brokers, auction houses and distilleries are all good places to start when trying to build a whisky collection. Distilleries often release exclusive bottles through their ‘fan-clubs’ or you can buy them direct.

Mr Simpson says the key is to look for iconic distilleries such as Macallan, which released 1,000 bottles in 2011 commemorating the royal marriage. These cost £150 each and now sell for £1,000.

He explains: ‘We come across collections of all shapes and sizes, however, our minimum transaction of £10,000 means these deals are usually more suited to more experienced collectors.’

You could outsource the selection process by investing in a fund where the manager will choose companies and bottles on your behalf.

There are no UK funds doing this so you would have to look to an offshore investment such as the Hong Kong-based Platinum Whisky Investment fund.

This would not be protected by the FSCS, but you could also put money into a fund investing more generally in drinks businesses, or buy shares direct.

For example funds such as Liontrust Special Situations and Newton UK Opportunities invest in drinks maker Diageo.

The connection between the performance of these funds, or even individual drinks companies, is a long way removed from how the whisky investing market moves, however.

How much will it cost to start a whiskey collection?

You will have the initial cost of buying the bottle, which can be anything from hundreds to thousands of pounds. So the more bottles you buy, the more it will cost to build your collection.

There are no other costs unless you want to pay a company for storage of a large collection.

Whisky only needs to be stored at a constant level at room temperature and kept upright avoiding contact between the cork and the spirit inside.

Mr Simpson says: ‘Most collectors will start with a small number of individual bottles and build from there. Many small collections are kept in an individuals home but when a professional collection becomes sizeable there are many storage companies who will take the hassle out of keeping the bottles. If you do keep a substantial collection of whisky at home, you will need to insure it.’

Bottled-up: You could sell or buy whisky at specialists such as Hedonism in London

How do you sell up and much profit can you make?

You can either sell your whisky through a broker, a specialist shop or at an auction.

The price you get depends on several factors such as the brand, the age of the whisky and where it came from.

Much of it is down to demand, how many bottles were made and the mood of the buyers.

For example, in 2010 Balvenie sold a batch of Tun 1401 bottles for £150 each, they now sell for around £1,800 at auction.

Mr Green says: ‘There are now many magazines and blogs devoted to whisky and whisky collecting which offer statistics and advice. Whisky auctions provide another source of information.

‘By studying the movement of prices over a period and talking to the specialists collectors can gain some idea of how their portfolio may perform if brought to market. It’s worth adding that auction houses are usually careful to stick to the facts and not to make specific investment recommendations – that has to be for the judgement of the collector.’

Mr Simpson warns that you have to be patient as whisky is a 10-20 year investment at least and research is key, he says: ‘There’s also the real potential for serious losses, all the RW negative indices are moving further into the red almost monthly and some distilleries are currently experiencing a correction in values.’

Is whiskey a good investment?

Check the whiskey market here.

Whiskey can be a good investment under certain circumstances. In recent years, the popularity of investing in whiskey as a tangible asset has grown, driven by increasing demand and limited supply of rare and collectible bottles. Here are some factors to consider when evaluating whiskey as an investment:

- Rarity: Limited-edition or discontinued whiskies that are rare and hard to find tend to appreciate in value over time. Whiskies from closed distilleries or those with a limited production run can become highly sought after by collectors and enthusiasts.

- Age and Maturation: Older whiskies often command higher prices due to their extended maturation period, which enhances their complexity and flavor profile. Vintage bottles from specific years or exceptional cask finishes may also be more valuable.

- Brand Reputation: Established and reputable whiskey brands with a history of producing high-quality products tend to hold their value better in the market. Brands that have gained recognition and awards for their whiskies are often considered more desirable by collectors.

- Limited Edition Releases: Limited edition releases or special bottlings, such as single cask expressions or commemorative editions, can appreciate in value due to their exclusivity and unique characteristics.

- Market Trends: It’s essential to monitor market trends and demand patterns when considering whiskey as an investment. Researching auction results, consulting with experts, and staying informed about the whiskey market can provide insights into potential investment opportunities.

- Proper Storage: Whiskey should be stored in suitable conditions to maintain its quality and value. Factors such as temperature, humidity, and exposure to light can affect the aging process and the overall condition of the whiskey. Proper storage is crucial to preserve the investment value.

- Investment Horizon: Investing in whiskey requires a long-term perspective. While some bottles may appreciate in value relatively quickly, others may take years or even decades to reach their full potential. Patience and a willingness to hold onto the investment for an extended period are important.

It’s important to note that investing in whiskey carries risks and uncertainties. The value of whiskey can be subject to market fluctuations and the unpredictability of consumer preferences. Furthermore, the whiskey market is not as regulated as other investment markets, which can increase the risk of fraud or counterfeit bottles.

If you’re considering whiskey as an investment, it’s advisable to seek guidance from experts in the field, attend whiskey auctions, and conduct thorough research before making any purchasing decisions. Additionally, investing in whiskey should be seen as a diversification strategy within a well-balanced investment portfolio rather than relying solely on this asset class.

10 Collectible Whiskies

- The Macallan Fine & Rare Collection: This series of vintage single malt whiskies from The Macallan distillery, spanning several decades, is highly collectible and known for its exceptional quality.

- Bowmore Black Bowmore: Produced by the Bowmore distillery, Black Bowmore is a limited edition series that consists of only a few thousand bottles. It is highly sought after by collectors due to its rarity and distinctive peaty character.

- Glenfiddich Janet Sheed Roberts Reserve 1955: Released to celebrate the 110th birthday of Janet Sheed Roberts, the granddaughter of Glenfiddich founder William Grant, this limited edition whisky is highly collectible due to its historical significance and limited availability.

- Ardbeg Limited Editions: Ardbeg, known for its peaty and smoky whiskies, releases various limited editions throughout the years. These bottles often feature unique packaging and special cask finishes, making them popular among collectors.

- The Dalmore Constellation Collection: The Dalmore Constellation Collection comprises a series of rare and aged single malt whiskies from the Dalmore distillery. Each bottle represents a specific vintage and showcases the craftsmanship and character of the distillery.

- Springbank 21-Year-Old: Springbank is a renowned distillery in Campbeltown, Scotland, and their 21-year-old expression is highly regarded among whisky enthusiasts. Its limited production and aging process contribute to its collectibility.

- Port Ellen Silent Distillery Releases: Port Ellen, a distillery that closed its doors in 1983, has become highly collectible. Bottles from their Silent Distillery Releases series, featuring whiskies from the shuttered distillery, are highly sought after by collectors.

- Highland Park 50-Year-Old: Highland Park, located in the Orkney Islands, is known for producing exceptional whiskies. Their 50-year-old expression is a limited edition release that showcases the distillery’s craftsmanship and offers a rare and collectible experience.

- The Glenlivet Winchester Collection: The Glenlivet, one of the oldest legal distilleries in Scotland, has released the Winchester Collection, featuring rare and aged single malt whiskies. Each bottle represents the expertise of the master distiller and is highly collectible.

- Yamazaki Sherry Cask 2013: From the renowned Japanese distillery Yamazaki, the Sherry Cask 2013 release gained international acclaim and became highly sought after by collectors. Its scarcity and unique flavor profile make it a valuable addition to any whisky collection.

Please note that the availability and prices of collectible whiskies may vary over time, and it’s important to research and consult reputable sources for up-to-date information.

Whiskey Investment FAQ

Q: Is whiskey a good investment option?

A: Whiskey can be a good investment option under certain circumstances. Factors such as rarity, age, brand reputation, and limited edition releases can contribute to the value appreciation of certain whiskies.

Q: What types of whiskies are considered collectible?

A: Collectible whiskies often include limited-edition releases, whiskies from closed distilleries, rare vintages, and whiskies with unique characteristics or finishes.

Q: How long should I hold onto whiskey as an investment?

A: Investing in whiskey typically requires a long-term perspective. Some bottles may appreciate in value relatively quickly, while others may take years or even decades to reach their full investment potential.

Q: Are there any risks associated with investing in whiskey?

A: Yes, investing in whiskey carries certain risks. The value of whiskey can be subject to market fluctuations and the unpredictability of consumer preferences. There is also a risk of counterfeit bottles in the market.

Q: How can I determine the value of a whiskey bottle?

A: The value of a whiskey bottle is determined by various factors, including its rarity, age, brand reputation, and market demand. Consulting with experts, monitoring auction results, and staying informed about the whiskey market can provide insights into a bottle’s value.

Q: What is the best way to store whiskey for investment purposes?

A: Proper storage is essential to maintain the quality and value of whiskey. Whiskey should be stored in a cool, dark place with a stable temperature and humidity level. Avoid exposure to direct sunlight or extreme temperature fluctuations.

Q: Are there any resources or experts that can provide guidance on whiskey investments?

A: There are whiskey investment experts and consultants who can offer guidance on whiskey investments. Additionally, attending whiskey auctions, participating in whiskey investment forums, and conducting thorough research can provide valuable insights.

Q: Can whiskey investments generate returns comparable to other investment options?

A: The returns on whiskey investments can vary. While some bottles may appreciate significantly over time, it is important to remember that whiskey investments should be seen as a diversification strategy within a well-balanced investment portfolio.

Q: How can I ensure the authenticity of a whiskey bottle?

A: Authenticating a whiskey bottle can be challenging, as counterfeit bottles exist in the market. It is advisable to purchase from reputable sources, verify the bottle’s provenance, and consult experts when in doubt.

Q: Are there any legal or regulatory considerations when investing in whiskey?

A: The legal and regulatory considerations may vary depending on the country or region. It is important to familiarize yourself with the laws and regulations related to buying, selling, and investing in alcoholic beverages in your jurisdiction.

Q: Can whiskey investments provide both financial returns and personal enjoyment?

A: Yes, investing in whiskey can offer the potential for financial returns, but it can also be an enjoyable hobby for whiskey enthusiasts. Many investors appreciate the combination of investment potential and the opportunity to explore and taste different whiskies.